· record books · 12 min read

Best Car Mileage Logbooks for Accurate Mileage Tracking

Discover the top-rated car mileage logbooks to efficiently track your vehicle's mileage, expenses, and maintenance records.

Stay organized and compliant with the best car mileage logbooks. These versatile and user-friendly notebooks provide a comprehensive solution for recording and managing your vehicle's mileage and related expenses. Keep a detailed history of your car's fuel consumption, maintenance costs, and other expenses to maximize efficiency and streamline tax deductions. Our curated selection offers a range of logbooks tailored to different needs and preferences.

Overview

PROS

- Records over 400 rides or sessions, ensuring comprehensive mileage tracking.

- Essential for business driving or rideshare apps, helping you maximize reimbursements and deductions.

CONS

- May require multiple logbooks for extended periods of time.

- Might not be suitable for highly detailed expense tracking.

This Auto Mileage & Expense Notebook is an indispensable tool for drivers seeking a reliable way to track their mileage and expenses. Its compact size (5 x 8 inches) and ample pages (60) provide ample space for recording over 400 rides or sessions, whether for business or personal use. The notebook's intuitive design simplifies the logging process, ensuring you capture essential details such as odometer readings, dates, and destinations.

For those who rely on business driving or rideshare apps, this notebook is a must-have. It enables you to accurately track your mileage, a crucial step in maximizing reimbursements or deductions. By keeping a meticulous record of your expenses, you can streamline your financial management and ensure you're getting the most out of your driving endeavors. Overall, this Auto Mileage & Expense Notebook is an excellent choice for anyone seeking a convenient and effective way to manage their vehicle-related expenses.

PROS

- Comprehensive car mileage logbook for accurate tracking of all vehicle expenses and gas consumption.

- Durable hardcover and A5 size provide portability and easy access.

CONS

- Lacks specific sections for odometer readings or maintenance events.

- The cover color (Gray) may not suit all preferences.

The Skyline Auto Mileage Log Book is an indispensable tool for meticulously tracking your vehicle's mileage, expenses, gas consumption, and lubrication. Its comprehensive format ensures that you have a clear record of every trip, making it an invaluable aid for both personal and business use. Its compact A5 size and sturdy hardcover ensure its durability and portability, allowing you to keep it handy in your car for effortless logging.

The logbook's versatility extends to its expense tracking capabilities. You can effortlessly record fuel expenses, tolls, maintenance costs, and other vehicle-related expenditures, providing you with a clear overview of your vehicle's financial impact. By harnessing the power of this logbook, you gain valuable insights into your driving habits, fuel efficiency, and overall vehicle performance, empowering you to make informed decisions about your vehicle's upkeep and usage.

PROS

- Comprehensive tracking: Record mileage, expenses, and maintenance for all your vehicles.

- Tax-ready: Easily prepare for audits and maximize deductions with this logbook.

- User-friendly design: A5 size, simple layout, and ample space for entries.

CONS

- Cover material may be susceptible to wear and tear over time.

- Number of entries may be insufficient for high-mileage drivers.

Keep your vehicle expenses organized and your tax preparation stress-free with the JUBTIC Auto Mileage Log Book. This A5-sized logbook provides a comprehensive solution for tracking mileage, expenses, gas consumption, and lubrication for multiple vehicles. With 1,674 mileage entries, you'll have ample space to record every trip, whether for business or personal use.

The JUBTIC mileage logbook simplifies tax preparation by providing a detailed record of your vehicle-related expenses. By having this information readily available, you can maximize your deductions and ensure compliance with tax regulations. Its user-friendly design, with a simple layout and ample space for entries, makes it easy to maintain accurate records throughout the year.

PROS

- Easily jot down gas mileage, expenses, lubrication, and other events.

- Spacious pages allow ample space for comprehensive logging.

CONS

- Mileage entries are limited to 1,674, may not suit drivers with extremely high mileage.

- The A5 size might be too bulky for some glove compartments.

The Clever Fox Mileage Log Book presents a comprehensive solution for keeping track of your vehicle's expenses and performance. Designed to maximize clarity and organization, the logbook efficiently records mileage, gas consumption, lubrication schedules, and other relevant data. Its ample page space ensures ample room for detailed entries, empowering you to maintain precise records for tax, business, or personal purposes.

Meticulously crafted with high-quality materials, this mileage logbook stands out with its exceptional durability. Its portable A5 size allows for convenient storage in your vehicle or workspace. The thoughtful layout and user-friendly design make logging effortless, promoting consistent and accurate record-keeping. Whether you're a professional driver looking to optimize expenses or a car enthusiast seeking to monitor your vehicle's performance, the Clever Fox Mileage Log Book is an indispensable tool that empowers you with comprehensive insights into your vehicle's usage and costs.

PROS

- Provides clear and organized mileage tracking for business or personal use.

- Compact and portable for effortless storage in your car.

- Contains predefined sections for odometer readings, dates, destinations, purpose of trips, and expenses related to vehicle maintenance, gas, and parking.

CONS

- Might not be suitable for tracking complex or multiple vehicle mileage.

Whether you're a seasoned business traveler or an individual looking to keep a meticulous record of your mileage, this 2-pack of Auto Mileage Log Books has you covered. Its compact 5 x 7.87-inch size makes it easily portable, allowing you to keep it in your car for quick access.

Each logbook features predefined sections for essential information, including odometer readings, dates, destinations, and trip purposes. It also includes dedicated spaces to track vehicle-related expenses such as gas, parking, and maintenance, providing a comprehensive view of your automotive costs. This organized approach ensures that you have all the necessary documentation for reimbursement claims or tax deductions.

PROS

- Track all essential mileage and maintenance details in one convenient place.

- Easily record expenses, gas consumption, lubrication, repairs, and accessories to optimize vehicle performance and budgeting.

CONS

- May require regular updating for accuracy.

Introducing the ultimate car mileage logbook, the indispensable tool for savvy drivers seeking to optimize their vehicles' performance while keeping a sharp eye on expenses. With a generous capacity for 1768 rides, this logbook empowers you to effortlessly keep track of every vital aspect of your car's maintenance. Effortlessly monitor mileage, expenses, gas consumption, lubrication, repairs, and accessories, ensuring your vehicle runs smoothly while helping you stay on top of your budget.

This comprehensive mileage logbook not only serves as a meticulous record-keeping tool but also plays a crucial role in tax preparation, providing auditors with clear and organized documentation. Its compact size makes it easy to store in your glove compartment for quick and convenient access whenever you need to jot down essential information. Invest in this mileage logbook today and experience the benefits of streamlined vehicle maintenance, enhanced budgeting, and simplified tax preparation.

PROS

- Tracks vehicle mileage, expenses, and other relevant information.

- Convenient 5" x 7" size with 126 pages of organized note-taking space.

CONS

- May not be as comprehensive as some other mileage logbooks.

- Wire-O binding could potentially snag on other items.

PROS

- Straightforward layout and design, ensuring ease of use for all drivers

- Compact size (5.75 x 8.5 inches) allows for effortless storage in vehicles, backpacks, or purses

CONS

- Does not include additional features such as GPS tracking or electronic integration

- Manual input of information requires attention to detail and diligence

The Action Mileage Book stands as an exceptional choice for mileage tracking, empowering individuals and businesses to maintain accurate and organized records. Its intuitive design and compact size make it a breeze to use, enabling drivers to seamlessly record miles, gas usage, and other essential data. Whether you're a small business owner, an independent contractor, or managing a fleet of vehicles, this mileage logbook offers an effective solution to your mileage tracking needs.

Enhancing its functionality, the Action Mileage Book provides ample space for recording details, ensuring comprehensive mileage tracking. The thoughtful layout allows for easy data entry and retrieval, saving you valuable time and effort. Additionally, the book's durable construction guarantees longevity, withstanding the rigors of daily use and transportation.

PROS

- Two-pack for personal and business use

- Compact size for easy portability

- Clear sections for detailed record-keeping

CONS

- Limited space for additional notes

- No preprinted dates

Keep your car expenses organized with the INKNOTE Car Mileage Log Book, your go-to tool for accurate record-keeping. Its compact size makes it conveniently portable, while the clear sections guide you through essential details. Whether you're a business owner tracking deductible expenses or monitoring personal driving costs, the INKNOTE logbook has got you covered.

This handy logbook includes space to document dates, distances traveled, destinations, and fuel consumption. Plus, the two-pack provides a convenient backup for your mileage records. However, note that it doesn't include preprinted dates, so you'll need to fill them in manually. If you're looking for a comprehensive mileage tracking solution that fits your on-the-go lifestyle, the INKNOTE Car Mileage Log Book is an excellent choice.

PROS

- Compact and glove box-friendly design for easy storage during travels

- 588 mileage entries allow for detailed tracking of multiple vehicles over an extended period

CONS

- Receipt pockets may not be suitable for holding larger receipts

- Pre-printed entries limit customization options

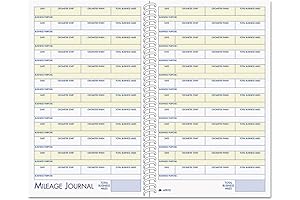

Introducing the Adams ABFAFR12 Mileage and Expense Journal, an indispensable tool for meticulous drivers seeking to simplify mileage tracking and expense management. Its compact size and spiral binding make it an excellent fit for any glove box, providing easy access when you're on the go. With 588 pre-printed mileage entries, you can confidently log your travels, ensuring accurate record-keeping. Additionally, you'll find six receipt pockets conveniently located within the journal, keeping expense receipts organized and readily available for reference or submission.

The Adams ABFAFR12 Mileage and Expense Journal goes beyond basic mileage tracking. It allows you to record essential trip details, including the start and end odometer readings, destination, purpose of the trip, and additional notes. This comprehensive approach not only simplifies reimbursement claims but also supports efficient business expense management. Its versatility makes it suitable for personal and professional use, helping you maintain precise records for tax purposes or reimbursement requests.

Selecting the right car mileage logbook empowers you with organized records for all your vehicle-related expenses. Whether you're a business owner, a frequent driver, or simply want to keep track of your car's performance, a mileage logbook is an indispensable tool. By maintaining meticulous records, you'll be able to maximize your tax deductions, track maintenance expenses, and make informed decisions about your vehicle's upkeep.

Frequently Asked Questions

What advantages do car mileage logbooks offer?

Car mileage logbooks provide numerous benefits, including organized expense tracking, maximized tax deductions, simplified budgeting, efficient maintenance scheduling, and comprehensive vehicle records.

What key features should I look for in a car mileage logbook?

When selecting a car mileage logbook, consider factors such as durability, ease of use, space for detailed entries, expense tracking capabilities, and overall value for money.

How frequently should I update my car mileage logbook?

For optimal accuracy and up-to-date records, it's recommended to update your car mileage logbook after every trip or as often as possible.

Can car mileage logbooks assist in vehicle maintenance scheduling?

Yes, car mileage logbooks help you track your vehicle's mileage and maintenance intervals, allowing you to schedule maintenance promptly and avoid costly repairs.

How do car mileage logbooks contribute to tax deductions?

Car mileage logbooks provide detailed records of your vehicle's business-related mileage, which is essential for claiming tax deductions and maximizing your tax savings.